Page 128 - IJPS-11-2

P. 128

International Journal of

Population Studies Country choice for migrant entrepreneurship

cutting-edge technological and industrial enterprises

(Calviño, 2022). Becoming an entrepreneur in Europe

requires meeting two crucial prerequisites: first, strict

compliance with existing legislation enabling the

commencement of commercial operations in any EU

country where the business is established; and second,

possessing unwavering determination and resilience to

wholeheartedly embrace and cultivate the following:

• Legal compliance: Adhering to the legal requirements

to start a business in the EU

• Adaptability and resilience: Possessing such qualities

to navigate the challenges of entrepreneurship

• Focus and commitment: Demonstrating such

attributes in the business endeavor

• Value of learning: Recognizing this value and

remaining committed to acquiring new skills.

Therefore, embarking on an entrepreneurial journey in

Europe, especially as a foreigner, is a significant endeavor.

The Support Adventure classification of the easiest

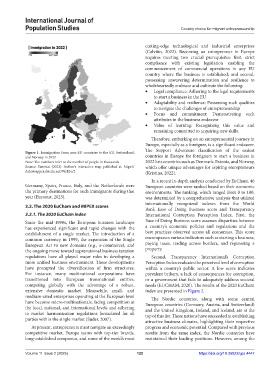

Figure 1. Immigration from non-EU countries to the EU, Switzerland,

and Norway in 2022 countries in Europe for foreigners to start a business in

Note: The numbers refer to the number of people in thousands. 2022 lists countries such as Denmark, Estonia, and Norway,

Source: Eurostat (2023). Author’s interactive map published at: https:// which offer unique advantages for aspiring entrepreneurs

datawrapper.dwcdn.net/WcEbc/2 (Kristina, 2022).

In a recent in-depth analysis conducted by EuCham, 46

Germany, Spain, France, Italy, and the Netherlands were European countries were ranked based on their economic

the primary destinations for such immigrants during that environments. The ranking, which ranged from 0 to 100,

year (Eurostat, 2023). was determined by a comprehensive analysis that utilized

internationally recognized indexes from the World

3.2. The 2020 EuCham and MIPEX scores

Bank Ease of Doing Business score and Transparency

3.2.1. The 2020 EuCham index International Corruption Perception Index. First, the

Since the mid-1990s, the European business landscape Ease of Doing Business score assesses disparities between

has experienced significant and rapid changes with the a country’s economic policies and regulations and the

establishment of a single market. The introduction of a best practices observed across all economies. This score

common currency in 1999, the expansion of the Single encompasses various indicators such as starting a business,

European Act to new domains (e.g., e-commerce), and paying taxes, trading across borders, and registering a

the ongoing move toward supranational business taxation property.

regulations have all played major roles in developing a Second, Transparency International’s Corruption

more unified business environment. These developments Perception Index evaluates the perceived level of corruption

have prompted the diversification of firm structures. within a country’s public sector. A low score indicates

For instance, many multinational corporations have prevalent bribery, a lack of consequences for corruption,

transitioned into European transnational entities, or a government that fails to adequately address societal

competing globally with the advantage of a robust, needs (EUCHAM, 2020). The results of the 2020 EuCham

extensive domestic market. Meanwhile, small- and index are presented in Figure 2.

medium-sized enterprises operating at the European level The Nordic countries, along with some central

have become micro-multinationals, facing competition at European countries (Germany, Austria, and Switzerland)

the local, national, and international levels and adhering and the United Kingdom, Ireland, and Iceland, are at the

to market harmonization regulations formulated for all top of this list. These nations have succeeded in establishing

parties within the single market (Suder, 2007). attractive business climates, highlighting their respective

At present, entrepreneurs must navigate an exceedingly progress and economic potential. Compared with previous

competitive market. Europe teems with top-tier brands, results from the same index, the Nordic countries have

long-established companies, and some of the world’s most maintained their leading positions. However, among the

Volume 11 Issue 2 (2025) 122 https://doi.org/10.36922/ijps.4447